When it comes to ensuring the well-being of your employees, large group health insurance is a crucial element of your organization’s benefits package. Long Beach, with its vibrant community and diverse workforce, offers a multitude of options for large group health insurance coverage. In this blog, we’ll explore the key factors to consider when searching for the right Long Beach large group health insurance plan for your organization.

- Evaluate Your Organization’s Needs

The first step in securing the ideal large group health insurance plan in Long Beach is to assess your organization’s specific needs. Consider the size of your workforce, the demographics of your employees, and any unique health requirements they may have. Are you seeking comprehensive coverage, or do you prefer a plan with more limited options? Identifying your organization’s needs will guide your search.

- Seek Local Expertise

Navigating the world of insurance can be complex, and Long Beach has its own nuances. It’s essential to consult with local experts who understand the unique dynamics of the area. A local insurance broker or consultant can help you identify the best insurance providers and plans tailored to Long Beach’s healthcare landscape.

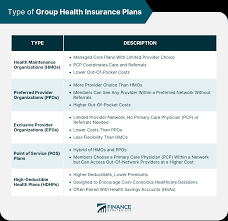

- Explore Plan Options

Long Beach offers a variety of large group health insurance plans, each with its own features and benefits. Some plans may provide a broad network of healthcare providers, while others might focus on affordability. Explore different options to find the one that aligns with your organization’s priorities. Be sure to look into factors such as deductibles, copayments, and coverage for prescription drugs and preventive care.

- Consider Employee Wellness Programs

Employee wellness programs are becoming increasingly popular in Long Beach and elsewhere. These programs can be incorporated into your large group health insurance plan to encourage a healthier and more engaged workforce. In Long Beach, you’ll find numerous opportunities to promote well-being, from fitness classes to outdoor activities.

- Stay Informed About Legal Requirements

California, like other states, has its own set of regulations and legal requirements for large group health insurance. Be sure to stay informed about these requirements, including any changes in state or federal laws that might affect your organization’s insurance obligations.

- Review Provider Networks

The choice of healthcare providers is critical in Long Beach large group health insurance. Ensure that your selected plan includes reputable hospitals, clinics, and specialists in the Long Beach area. A comprehensive provider network ensures that your employees have easy access to quality healthcare.

Conclusion

Choosing the right Long Beach large group health insurance plan is a significant decision for your organization and its employees. By carefully assessing your needs, seeking local expertise, exploring various plan options, and staying informed about legal requirements, you can navigate the waters of large group health insurance with confidence. Remember that a well-structured plan not only safeguards your employees’ health but also contributes to their overall well-being and job satisfaction.

Don’t hesitate to reach out to local experts and insurance providers to start the journey towards comprehensive and affordable large group health insurance for your organization in beautiful Long Beach. Your employees’ health and happiness are worth the investment.