Buying a home is a significant life decision, one that often involves a complex and multifaceted process. Whether you’re a first-time homebuyer or an experienced property investor, embarking on a home survey can make all the difference in finding your ideal sanctuary. In this blog post, we’ll delve into the world of home surveys, exploring what they are, why they matter, and how they can help you make the most informed real estate decisions.

Understanding the Home Survey

A home survey is essentially a comprehensive inspection and evaluation of a property before you commit to purchasing it. It’s a crucial step in the homebuying process, offering you invaluable insights into the condition and value of the property. Let’s break down the different aspects of a home survey:

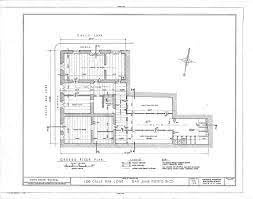

1. Property Inspection

The core of a home survey involves a meticulous inspection of the property. A certified surveyor or inspector will thoroughly examine the structural integrity, foundation, roofing, plumbing, electrical systems, and more. They’ll look for any existing issues or potential problems that might need your attention.

2. Appraisal

A professional appraiser assesses the property’s market value based on its condition, location, and recent comparable sales in the area. This step ensures that you’re not overpaying for your new home and that the asking price aligns with its true value.

3. Legal Compliance

Home surveys also involve checking if the property complies with local zoning laws, building codes, and regulations. Ensuring that the property is legally sound can save you from future headaches and unexpected costs.

Why Home Surveys Matter

Now that we understand what a home survey entails, let’s explore why it’s such a crucial aspect of the homebuying process:

1. Informed Decision-Making

A home survey arms you with the knowledge needed to make informed decisions. Knowing the condition of the property and its market value allows you to negotiate effectively and avoid potential pitfalls.

2. Risk Mitigation

Identifying any structural or legal issues early on can save you from buying a property with hidden problems. It also provides an opportunity to request necessary repairs or adjustments before closing the deal.

3. Financial Security

Getting an accurate appraisal ensures that you’re making a sound investment. It prevents you from overpaying and helps you secure a mortgage with confidence.

Types of Home Surveys

There are various types of home surveys, each catering to different needs and situations. Some common types include:

- Basic Visual Inspection: This is a surface-level examination of the property’s condition, suitable for relatively new or well-maintained homes.

- Full Structural Survey: A comprehensive survey suitable for older or more complex properties. It examines every aspect of the property in detail.

- Mortgage Valuation Survey: Often required by lenders, this survey primarily assesses the property’s market value to determine the mortgage amount.

Conclusion

In your journey to find the perfect home, a home survey is your trusted companion. It’s an investment in knowledge that pays dividends in the form of informed decisions, reduced risks, and peace of mind. So, whether you’re considering a cozy apartment or a sprawling countryside estate, make sure to include a thorough home survey in your homebuying checklist. It might be the key to unlocking the door to your dream home.