When it comes to providing comprehensive baton rouge large group health insurance, the significance of a well-structured health insurance plan cannot be overstated. Businesses and organizations in this vibrant Louisiana city understand the value of prioritizing their employees’ health and well-being. Here’s why investing in large group health insurance in Baton Rouge is not just a beneficial decision but also a strategic one for employers and employees alike.

1. Supporting Employee Well-Being

Large group health insurance isn’t just a company benefit; it’s a testament to a business’s commitment to its employees’ health. Baton Rouge, known for its dynamic workforce, understands that providing robust health coverage helps in retaining and attracting top talent. Employees feel valued and supported when their employer offers comprehensive healthcare benefits, enhancing their overall job satisfaction and loyalty.

2. Enhanced Health Access and Coverage

Access to quality healthcare is vital, and large group health insurance plans in Baton Rouge are designed to offer extensive coverage. From routine check-ups to specialized treatments, these plans provide a wide network of healthcare providers, ensuring that employees have access to the medical services they need without facing significant financial burdens.

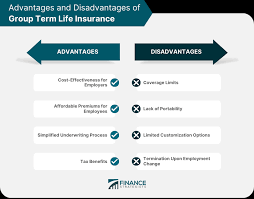

3. Cost-Effective Solutions for Businesses

For businesses in Baton Rouge, navigating the complexities of healthcare costs can be challenging. Large group health insurance plans often come with cost-effective options due to the risk-sharing nature of a larger pool of employees. This allows companies to provide robust coverage while managing expenses effectively.

4. Tailored Plans for Diverse Needs

Baton Rouge, with its diverse workforce, requires healthcare plans that cater to various needs. Large group health insurance offers flexibility in plan designs, allowing businesses to tailor coverage to meet the specific requirements of their employees. Whether it’s different tiers of coverage, additional wellness programs, or specialized benefits, these plans can be customized to suit the organization’s demographics and preferences.

5. Navigating Regulatory Changes

Healthcare regulations are constantly evolving, and staying compliant is crucial for businesses in Baton Rouge. Large group health insurance providers are well-versed in navigating these changes, ensuring that employers stay updated and their plans remain compliant with the latest regulations. This alleviates the administrative burden for businesses, allowing them to focus on their core operations.

Find Your Ideal Large Group Health Insurance in Baton Rouge

Investing in comprehensive large group health insurance in Baton Rouge is not just about meeting regulatory requirements; it’s a commitment to the well-being and satisfaction of your employees. Whether you’re a growing enterprise or an established organization, prioritizing healthcare benefits for your employees is a strategic move that yields long-term advantages for both the workforce and the company.

Make a difference in your workplace today by exploring tailored large group health insurance solutions in Baton Rouge, ensuring a healthier, more secure future for your employees and your business.